Dr. Ibrahim Latheef, Dean of Postgraduate Studies and prominent Maldivian academic with Villa College, expressed concern today over the Bank of Maldives’ (BML) recent moves regarding foreign currency spending, fearing it will restrict access to vital academic resources.

“This is very sad,” Dr. Latheef said. “How will we pay for our academic journals, books, and international memberships?”

BML, the Maldives’ largest bank, is about to implement temporary limits on dollar usage as per media reports.

Dr. Latheef’s concerns highlight the potential impact of these restrictions on the academic community. Many academic materials, including journals, books, and online databases, are priced in US dollars and often require international subscriptions. Limited access to these resources could hinder research, teaching, and learning in Maldivian institutions.

Uncertainty Amidst Conflicting Reports and Black Market Activity

Adding to the confusion, BML officials were quoted in the media as saying that the card limit for Rufiyaa accounts might be reduced by up to 90% due to difficulties in obtaining dollars. This sparked panic in the media, prompting the Ministry of Finance to issue a clarifying statement. The Ministry asserted that BML had not decided to limit transactions in dollars with BML cards.

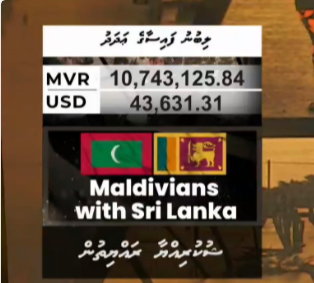

However, the situation is further complicated by the black market’s role in currency exchange. The dollar is currently trading at above MVR 18 on the black market, more than the official rate of MVR 15.42. There is a reported decrease in the number of people exchanging dollars through banks, a shift towards the black market, which has significantly depleted the bank’s dollar reserves.

Impact on Academia

Despite the Ministry’s clarification, uncertainty persists regarding the long term impact on academic spending. Even the current limits pose challenges, and potential further reductions could have severe consequences on Maldivian students abroad. Academics worry about:

- Restricted access to essential resources: Journals, books, online databases, and international memberships, crucial for research and education, might become unaffordable.

- Disadvantage for young academics: Younger researchers who rely heavily on online resources and international collaborations could be disproportionately affected.

- Delays and disruptions: The unclear exemption process for essential academic needs could lead to delays and disruptions in accessing critical resources.

Possible Solutions

Dr. Latheef urges BML and the government to consider alternative solutions, such as:

- Increased limits for specific academic needs: Establishing dedicated quotas for academic purchases could ensure access to essential resources while managing overall foreign currency expenditure.

- Streamlined exemption process: Providing a clear and efficient process for academics to demonstrate the essentiality of their dollar spending would alleviate concerns and delays.

- Alternative payment methods: Exploring partnerships with international academic publishers or facilitating alternative payment methods could offer more flexibility.

Finding a Sustainable Path Forward

While BML’s measures address national economic concerns, it’s crucial to find solutions that balance these needs with the crucial role of academic research and education in the Maldives’ development. Open communication and collaboration between BML, academics, the Ministry of Finance, and relevant stakeholders are key to finding sustainable solutions that ensure continued access to knowledge and empower Maldivian academia to thrive says Dr. Latheef.