SINGAPORE — The country is navigating a series of economic challenges as detailed in a recent report by Standard Chartered Bank. The report, titled “Maldives – Swimming Against the Current,” was released on July 26 and provides insights into external liquidity risks, fiscal challenges, and trends in the tourism sector.

External Liquidity Risks

The country’s foreign exchange reserves have decreased to $509 million as of June 2024, down from $832 million in late 2022. The current account deficit is projected to exceed $1.2 billion, or approximately 17% of GDP, in 2024. This is largely due to a reliance on imports for basic goods and a narrow export base. Additionally, significant external debt repayments are due, with maturities expected to reach $265 million in 2025 and $820 million in 2026, creating external financing pressures.

Fiscal Challenges

Authorities recognize the necessity for fiscal prudence amid structural economic concerns. Implementing reforms remains a challenge in the current economic landscape. The fiscal deficit is expected to stay above 10% of GDP in 2024 due to high spending levels. While revenue mobilization efforts have been announced, they may face delays, complicating the fiscal outlook.

Tourism Sector Dynamics

Tourism, contributing about 24% of the country’s annual GDP, saw a 13.4% increase in visitor arrivals in 2023. However, the sector contracted by around 1% due to changes in consumer behavior, such as shorter stays and decreased spending. There is a growth in mid-market tourism, with more tourists opting for budget accommodations. This shift has affected overall tourism receipts, which fell by 6.8% in 2023.

Economic Projections

The GDP growth forecast for 2024 has been revised downward to 4.9%, reflecting ongoing sluggishness in key sectors like tourism and construction. The lack of economic diversification limits the country’s ability to generate revenue beyond tourism, posing structural economic constraints.

Debt Management and Financing Needs

The country’s debt-to-GDP ratio is expected to remain above 100% due to consecutive years of wide fiscal deficits. Over $1 billion in debt service obligations are projected for 2024 and 2025. The government has proposed an ambitious refinancing plan to manage debt maturities, including a liability management exercise aimed at repaying the sukuk due in 2026. This plan, while promising, faces skepticism amid current market conditions.

External Support and Funding

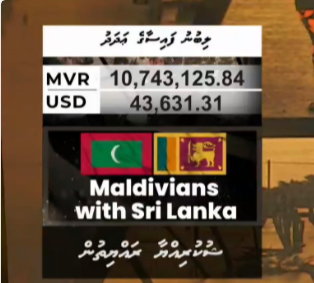

Financial assistance from international lenders is crucial for the country to meet its repayment obligations, particularly in 2026. Funding pledges have been received from China ($130 million) and Saudi Arabia ($150 million), among others, to support the country’s economic stability.

Conclusion

Despite maintaining its luxurious tourism appeal, the country faces notable economic challenges. The reliance on imports, external liquidity risks, and fiscal deficits highlight areas of vulnerability. With strategic reforms and diversification efforts, the country can enhance its financial stability and growth prospects.