Last week, the Bank of Maldives (BML) took center stage in economic discussions in the Maldives following the government’s decision to dismiss five directors, including the Chairman. This development has prompted a reflective examination of the intricate interplay between national financial interests, government political pledges, and the stability of the banking sector.

The country, renowned for its sun, sea, sand, and upscale resorts, heavily relies on tourism, a sector that significantly contributes to its revenue in US dollars. Approximately 90 cents of each earned dollar is directed abroad for exports and expatriate remittances, impacting the country’s dollar reserves. The recent government proposal to raise the student USD card limits to $1,200 from February faced resistance from BML, citing concerns over dwindling dollar reserves.

The discord intensified as BML discontinued dollar support to businesses, emphasizing its reliance on maintaining robust dollar reserves. Structured as a public limited company, BML found itself in a standoff with the government, holding a dominant stake of 62.2%.

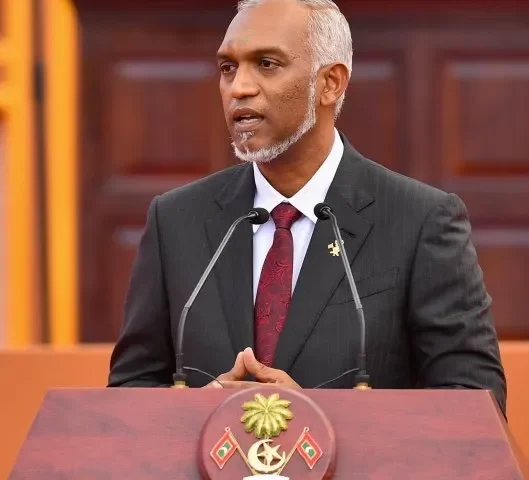

In a decisive move, the government ousted five board members, resulting in a board composition falling below the legal requirement of eight members. This left BML in a state of indecision, limiting its ability to take essential actions, except in emergencies, as dictated by the bank’s articles of association.

Following these developments, Managing Directors Karl Stumke and Aishath Nooruddin, along with other representatives of ordinary shareholders, retained their positions on the board. However, an unexpected turn occurred when the government reversed its decision on Thursday, reinstating two of the dismissed non-executive board members, seemingly to restore stability to BML’s leadership.

Despite this attempted resolution, an evident unease persists within the financial institution. As the Maldives grapples with the intricate balance between economic priorities, campaign pledges, and the autonomy of a major financial institution, uncertainties linger regarding the fate of student allowances, dollar reserves, and the future trajectory of BML.

The archipelago finds itself at an economic crossroads, navigating a nuanced path that seeks to preserve fiscal responsibility while maintaining its appeal to visitors.