MALÉ, Maldives — A shallow lagoon near a premier luxury resort is being dredged into an ultra-exclusive Land of legends theme park, even as the island nation’s environmental watchdog has ordered a freeze on all such excavation work to protect coral reefs during a bleaching crisis.

The exception for the lavish “Adventure Island” development, involving a Qatar-based company that purchased the prime lagoon last year from a prominent Maldivian businessman, has sparked allegations of double standards and conflicts of interest in the enforcement of environmental regulations across the archipelago.

The Maldives Environmental Protection Agency has ordered a temporary suspension of all dredging activities across the archipelago, citing concerns over coral bleaching from mid-May to mid-June. But one prominent project appears to have been granted an exemption, raising questions about the enforcement of environmental regulations and the potential for conflicts of interest.

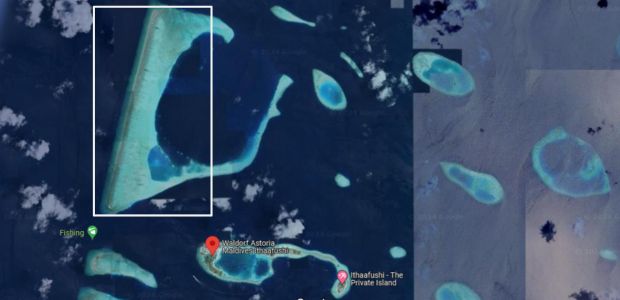

One apparent exception is the dredging work ongoing at Vaaredhdhoo Faru, a shallow lagoon close to the luxury Waldorf Astoria resort, which is being developed into an “Adventure Island” and a multi resort project by a Qatar based company. This lagoon was sold by Maldives philanthropist tycoon Qasim Ibrahim last year. The project’s provenance raises further questions.

Mr. Ibrahim, one of the Maldives’ most influential tycoons, has fought bitter court battles over the years to maintain control of strategic shallow lagoons across the archipelago, including sites like K. Atoll Bolidhihfaru, R. Atoll Maanenfushi, and Gdh. Atoll Gazeera. He sold Vaaredhdhoo Faru last year for $19 million to help finance his failed presidential bid, according to reports. But critics, including former President, have accused Ibrahim of not fulfilling commitments to undertake public-benefiting development activities in the prime lagoons under his purview, despite protracted legal wrangling to keep them.

While other developers have seen their reef dredging projects ordered to halt during the temporary ban, work at Vaaredhdhoo Faru, located just a 45-minute boat ride from the capital’s Velana International Airport, has continued unabated under a Dubai-based dredging firm.

The lack of transparency has stirred unease on social media and in the local press. “If the question is about coral bleaching and any temporary moratorium is to be imposed, shouldn’t it be squarely on all parties?” asked Abdulla Naseer, Attorney & Partner at Legal Aid LLP. “And why should one party be excluded?”

Beyond the specific Vaaredhdhoo Faru case, the broader confluence of interests has stoked public distrust. Adding to the suspicions, Foreign Minister Moosa Zameer visited Doha from May 11 to 14 – just days after the nationwide dredging suspension took effect on May 9. While no official link between the minister’s trip and the environmental exemption for the Qatar-based developer has been established, the timing has raised eyebrows among critics who view it as part of a broader pattern of privileged access for well-heeled investors with ties to influential local power brokers.

The convergence of prominent business interests, foreign capital investments and environmental policy decisions has fueled broader public unease about institutional safeguards and regulatory enforcement standards in the Maldives’ economically crucial tourism and real estate sectors. With global heating placing immense stress on coral systems worldwide through bleaching events.

Critics question why the government halted major foreign-funded dredging projects while the prominent Vaaredhdhoo Faru development proceeds apace. They have called for greater transparency around the environmental review process and any exceptions granted. With millions in investments put on hold, critics also ask whether those developers will be compensated for halting work they had already begun.

The Maldives, an archipelago of coral atolls, is one of the world’s lowest-lying nations and faces an existential threat from rising seas driven by global warming and environmental destruction. Protecting its fragile reef ecosystems is considered a national priority.

Yet the investor appears to have secured a special regulatory carve-out during the latest environmental suspension, allowing lucrative dredging to advance on this holding. The circumstances have raised suspicions of potential conflicts of interests or special treatment for well-connected domestic and international players.

TruthMV’s attempts to get EPA authorities to clarify the situation have been unsuccessful so far. Officials at the Environmental Protection Agency did not respond to calls and queries about the criteria for temporary bans and possible exemptions.

MAK Properties, headquartered in Qatar, has marketed its Adventure Island project on Vaaredhdhoo Faru, as an ultra-luxury destination “meticulously designed to cater to discerning families seeking an unparalleled retreat” across a sprawling area of nearly 2.5 million square meters.

But the dredging and reclamation work required to construct such massive overwater residences poses significant threats to the warm water coral reefs that help support marine biodiversity and buffer the nation’s low-elevation islands against erosion and flooding.

As global heating immensely stresses coral systems worldwide through bleaching events tied to unusually warm ocean temperatures, the Maldivian government has sought to limit further near-term damage by curtailing channelization and excavation projects during periods of peak environmental risk.

The EPA has defended the apparent exemption for Vaaredhdhoo Faru project, noting it was continuing with a special awarded permit, according to local media reports. But that has done little to quell broader concerns about fairness, favoritism and the outsize influence.