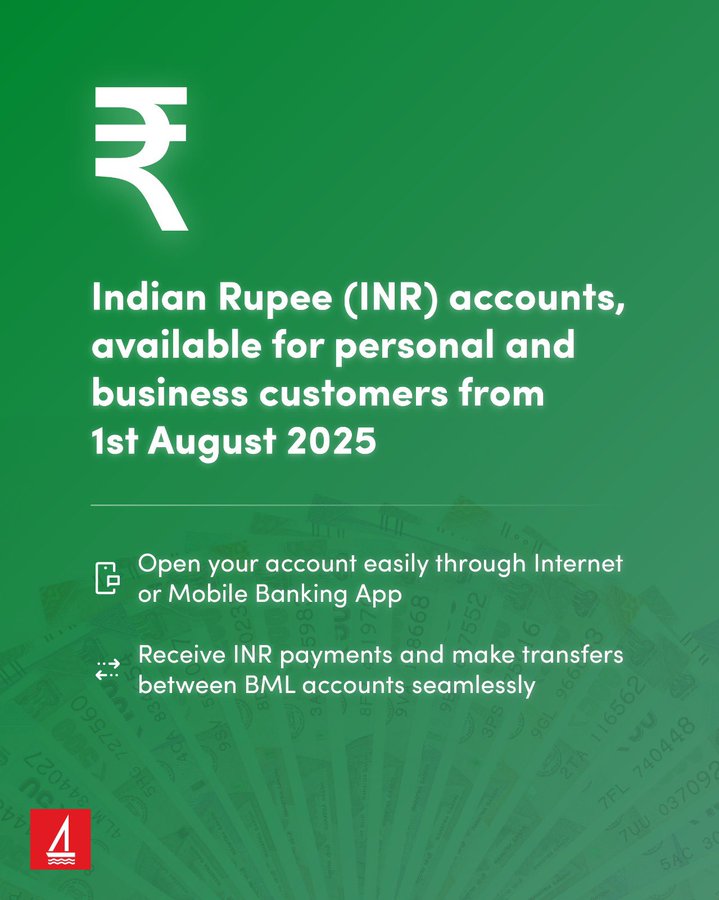

Malé, Maldives — In a significant move to deepen economic ties with India, the Bank of Maldives (BML) announced on Friday that it will begin offering Indian Rupee (INR) accounts for personal and business customers starting August 1, 2025. The decision, unveiled via social media, marks the first time the Maldivian financial sector will facilitate transactions in the Indian currency, signalling a strategic pivot amid evolving regional dynamics.

The new accounts, accessible through the bank’s Internet and Mobile Banking platforms, will allow customers to receive INR payments and conduct seamless transfers between BML accounts. This development comes as the Maldives seeks to capitalize on its growing economic relationship with India, a key tourism and trade partner.

According to industry analysts—the introduction of INR accounts is seen as a bid to strengthen financial linkages and encourage cross-border commerce. The move aligns with broader trends in remittance flows, with India’s diaspora remitting a record $111 billion globally in 2023, per World Bank data.

The State Bank of India’s Maldives branch, cramped in a shoebox-sized space and perpetually swamped, struggles to keep up with demand, its overworked staff barely managing the chaos. Its online INR remittances for Indians are a bright spot, but Maldivians face a steep 10 percent fee on USD withdrawals and transactions, whether at the ATM or the congested counter. BML’s new INR accounts, by contrast, position the bank to better serve Indian expatriates with the kind of efficient, respectful service SBI’s crowded quarters can’t muster.

The announcement has ignited excitement on social media, though some users raised questions about exchange rates and remittance fees. The initiative aligns with a 2024 International Monetary Fund study highlighting digital banking’s role in promoting financial inclusion in small economies like the Maldives.

Serving over 365,000 customers through a robust network of branches and digital platforms, BML is well-positioned to ensure a seamless rollout. Under President Muizzu’s direct guidance, the bank has also spearheaded efforts to make financial services more affordable, including expanding ATM access to the remotest corners of the country.