There is a dangerous financial undercurrent threatening to drown the Maldives in debt. What has become increasingly clear in 2025 is the stark contrast between two approaches to regional diplomacy. India’s steady hand of support versus China’s strangling debt trap that pushes vulnerable nations toward sovereign default. The numbers paint a difficult picture. Maldives’ total debt has exploded from $3 billion in 2018 to an alarming $8.2 billion as of early 2025, with projections showing it could balloon beyond $11 billion by 2029. Of this crushing burden, $3.4 billion is external debt, with China emerging as one of the primary creditors. This precarious financial situation now threatens the very sovereignty of a nation already fighting existential threats from rising sea levels.

China’s strategy in the Maldives follows a familiar playbook witnessed across the developing world and offer seemingly generous loans for infrastructure projects, secure unfavorable repayment terms, and then leverage the inevitable financial distress to extract strategic concessions.

The China-Maldives Free Trade Agreement, enacted in January 2025, exemplifies a calculated economic strategy that critics argue leans more toward dominance than equitable collaboration. This agreement, perceived as imbalanced, raises concerns about Beijing’s underlying objectives.

Of the approximately $700 million in bilateral trade, Maldives exports to China comprise less than 3 percent compared to China’s dominating 97 percent import share. The Maldives removed tariffs on 91 percent of Chinese goods, a massive concession that has yielded virtually no reciprocal benefit given the country’s narrow export base.

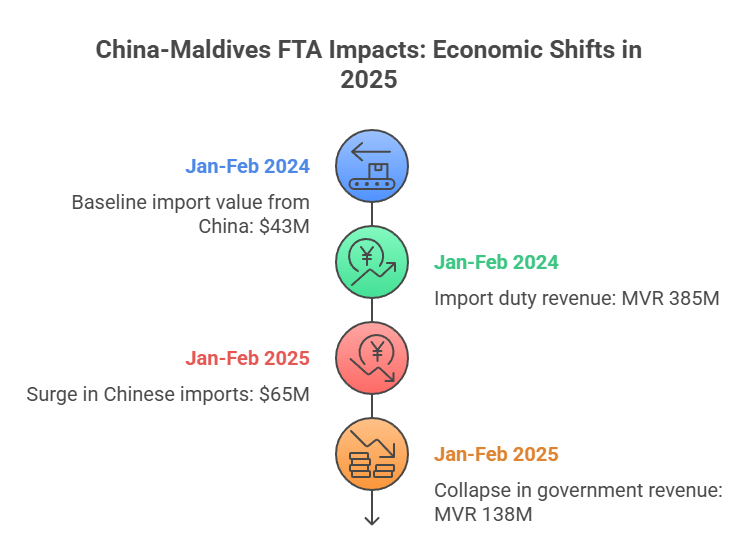

The immediate impacts have been devastating. Within just two months of the FTA’s implementation, imports from China surged to $65 million, up from $43 million during the same period the previous year. More damaging still is the catastrophic decline in government revenue from import duties, which plummeted by 64 percent – from MVR 385 million to a paltry MVR 138 million. The tourism sector, vital to the Maldivian economy, is progressively dominated by Chinese interests. As Chinese tourists flock to the islands, a growing share of the financial gains is channeled to Chinese companies, raising concerns about an arrangement that may disproportionately benefit external parties rather than bolstering the local economy.

When President Muizzu’s government desperately appealed to Beijing for $200 million in budget support from the China Development Bank, along with requests to refinance debt service payments and establish a currency swap, China’s response was deafening silence. The dominant party appears focused on securing its advantage rather than alleviating the pressures faced by its counterpart.

In contrast to concerns about China’s assertive economic strategies, India has demonstrated steadfast support for the Maldives during its most darkest financial hours. Despite political shifts in the Maldives that initially saw a pivot away from New Delhi toward Beijing, India has demonstrated what true regional partnership looks like.

Just this week, India rolled over a $50 million treasury bill to support the Maldives amid its economic challenges. This financial assistance wasn’t a one-off gesture but part of a continuing commitment – India has provided annual rollovers of treasury bills since 2019 under a unique government-to-government arrangement specifically designed as emergency financial assistance. When the Maldives faced a severe liquidity crisis last year that threatened to collapse the economy, the Reserve Bank of India extended crucial currency swap facilities amounting to $400 million and ₹30 billion. This lifeline arrived precisely when the Maldives was gasping for financial oxygen.

India’s $750 million currency swap has provided critical temporary relief for routine import payments and government expenditures. While insufficient to cover all upcoming debt obligations, particularly the looming $1 billion Sukuk repayment due in 2026 – India’s assistance demonstrates a commitment to preventing an economic collapse rather than exploiting it.

Foreign Minister Dr. Abdulla Khaleel’s public gratitude underscores the significance of India’s support: “This timely assistance reflects the close bonds of friendship between Maldives and India and will support the Government’s ongoing efforts to implement fiscal reforms for economic resilience.” These aren’t empty words but acknowledgment of the fundamental difference in approach between New Delhi and Beijing.

The Maldives’ significant debt to China, coupled with infrastructure projects, has raised concerns among observers about the risks of debt-driven influence, a pattern noted globally. The International Monetary Fund recently issued a stark warning about the Maldives’ “high risk of external and overall debt distress” without “significant policy changes,” a thinly veiled reference to the consequences of Chinese lending practices.

One need only look to neighboring Sri Lanka to see the endgame of China’s strategy. Unable to service massive Chinese loans, Sri Lanka was forced to surrender its strategically important Hambantota Port to a Chinese state company on a 99-year lease in 2017 – effectively ceding sovereign territory through financial coercion. Chinese loans for infrastructure projects with questionable economic returns but significant strategic value, followed by inevitable debt distress, culminating in China extracting concessions that would be unthinkable under normal diplomatic circumstances. It’s economic leverage through financial strategies rather than military might, as one South Asia diplomat noted.

The numbers expose the severity of the Maldives’ predicament. Foreign exchange reserves fell to a catastrophic low of $21.97 million in July 2024, briefly turning negative in mid-August – a crisis point for any nation. While reserves recovered to approximately $848.95 million by April 2025, the World Bank notes that “the coverage of usable reserves compared to short-term essential imports and external debt service needs – remains at historic lows.” The immediate financial challenge is staggering, with the Maldives needing to service external debt worth $600 million in 2025 and a crushing $1 billion in 2026. Meanwhile, credit rating agencies have responded predictably, with Fitch lowering the Maldives’ rating by three notches in consecutive cuts and Moody’s maintaining a negative outlook.

The Maldives now stands at a critical juncture, with its very sovereignty hanging in the balance. President Muizzu’s government has implemented numerous measures to address the crisis increasing taxes, divesting stakes in state-owned enterprises, and slashing expenditures but estimates suggest financing gaps exceeding $500 million in 2025 and $800 million in 2026 remain.

The contrast couldn’t be clearer. One neighbor offers a genuine lifeline with no strings attached; the other constructs a noose disguised as a safety rope.

As the Maldives navigates these intricate financial difficulties, the international community must recognize and address China’s lending practices as a form of economic influence with far-reaching implications.